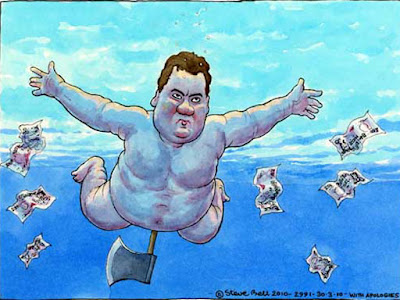

He's got a bum for a nose, got £3m from a family tax-avoiding trust fund for his 21st birthday, has made me and everybody else poorer, thicker and sicker… and yet I feel compelled to shout it from the rooftops:

GEORGE OSBORNE IS RIGHT

Firstly, many of these charities are simply fronts, convenient vehicles for hiding wealth. Remember Northern Rock? Advised by Barclays Capital, Citigroup, JP Morgan and Morgan Stanley, it used some very dubious shells which technically nominated charities as the ultimate beneficiaries, to avoid tax. The charities were never informed and never received any money.

Other charities are simply hobbies for the plutocratic elite. I like donkeys and opera as much as anybody else - maybe more - but I'd rather an elected government decided where cash needs to be directed than the whim of a fat cat who'd rather fund a polo team or Charity X6839, than a primary school.

X6839 explains here how the UK taxpayer (average salary £26,000) can donate to David Cameron's old school (annual fees: £31,000, music and sport extra), get the government to fork out more and even - if you earn over £42,000 - give you some tax back too! Everyone's a winner!

Net payment to Eton: £100,000

Tax reclaimed by Eton (basic rate plus transitional relief): £28,205

Value to Eton (gross donation): £128,205

Higher rate relief to you: £25,000

Your net cost as a higher rate taxpayer: £75,000

(Example from the Eton website linked to above)

Think of it as 'cashback' for toffs. If you think Lord Fink and his friends are relieving poverty or saving the environment, you're a fool.

However, this is all by-the-bye. The fact is that Osborne's limp little crackdown is simply an attempt to make the rich behave a little more like us.

When you give to charity you're giving from your own income, on which you've already paid tax. If you tick the 'gift-aid' box, the government gives a little bit of that tax to the charity.

The rich don't do it like this. They give to charity, then claim some tax back: they get a cheque from us which goes into their pockets - not to the charity.

Osborne's change is to say that they can only do that with a proportion of their incomes: some of them hide 100% of their cash in offshore charities which don't actually do anything charitable, avoiding all taxation. If they give to a real charity, the donor gets money back from the government. If they give to a shell charity, they rip us off and get paid from the money meant to educate, heal and defend us.

You'll be hearing a lot from various good charities and the posh universities about this. Oxford, Cambridge and so spend an awful lot of time beguiling the rich. Well, I don't care. This university is cramped, understaffed and under-resourced. We don't have a fleet of punts to maintain, and no billionaires are queuing up to endow us with funds. I'm quite happy for Oxbridge donors to shell out for research or the college wine cellars - but they should pay their taxes first, just like the rest of us. If they won't give without a tax break, they're giving for the wrong reasons.

So: Two Cheers For George Osborne.

No comments:

Post a Comment